Planning for a Farm Storage Building

ID

442-760 (BSE-248P)

A farm storage building is a good investment for many agricultural operations. The building can be used to store hay, machinery, or both. A good storage structure will protect hay and farm machinery from the weather thereby preventing the reduction in their value due to weather related damages. However, does the increased value of stored hay or machinery offset the cost of owning a building? The following discussion examines the costs and savings of owning a farm storage building.

Cost of Barn Storage

Barn storage is the best method for preserving hay and protecting machinery. However, a storage structure can be expensive to build. Initial building cost depends on several factors including building style, material costs, and labor costs. Initial cost of construction can range from $4.00 per square foot for an open-sided barn to over $6.00 per square foot for a fully enclosed barn.

To evaluate the feasibility of constructing a storage barn, the initial building cost must be converted into an annual cost. The annual cost of barn storage includes depreciation, interest on investment, repairs, taxes, and insurance. Table 1 shows how to calculate the annual cost of storage for the barn described in Example 1. You can enter your figures to estimate the cost of storage for your barn.

Example 1. Calculate the estimated cost of an open-sided barn that is 100 feet long and 50 feet wide.

100 feet x 50 feet = 5,000 square feet

5,000 square feet x $4.00/square feet = $20,000

| Costs for Example Barn |

|---|

Depreciation (20 years) = $20,000 ÷ 20 = $1,000 Interest on investment = 2/3 x 0.090 x $20,000 = $1,200 Repairs, taxes, and insurance = 0.020 x $20,000 = $400 Total Annual Cost = $2,600 |

| Costs for Your Barn |

|---|

$______ ÷ 20 = $______ 2/3 x ______ x $______ = $______ 0.020 x $______ = $______ = $______ |

1 This represents straight-line depreciation for managerial accounting purposes and should not be used for federal or state income tax preparation. Consult with your local Farm Business Management Extension Agent or a qualified accountant for more information on calculating depreciation for tax purposes.

Depreciation is the cost associated with wear and tear on the building. Most farm buildings have a useful life of 20 years. The annual cost of depreciation1 is found by dividing the initial building cost by the anticipated years of useful life of the building. Therefore, the annual cost of depreciation for the barn in Example 1 is $1,000 ($20,000 ÷ 20 years).

Interest on investment is the cost of borrowing money or, if the money is not borrowed, the money that could have been earned in interest if invested. For convenience, assume the interest on investment is equal to 2/3 of the current annual interest rate. Interest on borrowed money ranges from about 8.0 to 10.0 percent. Therefore, interest on investment has a range of 5.3 to 6.7 percent. Assuming an interest rate of 9.0 percent for the example barn, the annual cost of interest on investment is $1,200 (2/3 x 0.09 x $20,000).

Repairs, taxes, and insurance on the storage building are normally figured at 0.70 percent, 1 percent and 0.30 percent of initial cost, respectively, or a total of 2.0 percent. Therefore, the annual cost for these factors is $400 (0.02 x $20,000).

The total annual cost of a storage barn is the sum of the annual costs for depreciation, interest on investment, repairs, taxes, and insurance. For the barn in Example 1, the annual cost of barn storage is $2,600. However, to determine if barn storage is economical, the annual cost of storage needs to be compared to the benefit (income) of barn storage.

Benefits of String Hay in a Barn

Dry matter losses occur even under the best storage conditions with any type of hay. However, losses are greatest in large round bales. Numerous studies have compared dry matter losses in these bales under various storage methods. Table 2 presents the results of three hay storage studies, which clearly indicate that dry matter losses were greatest in unprotected bales stored on the ground.

The reduction in dry matter losses caused by storing hay in a building often results in increased savings. To illustrate this, two examples are given that calculate the value of large round bales stored in a building and unprotected on the ground.

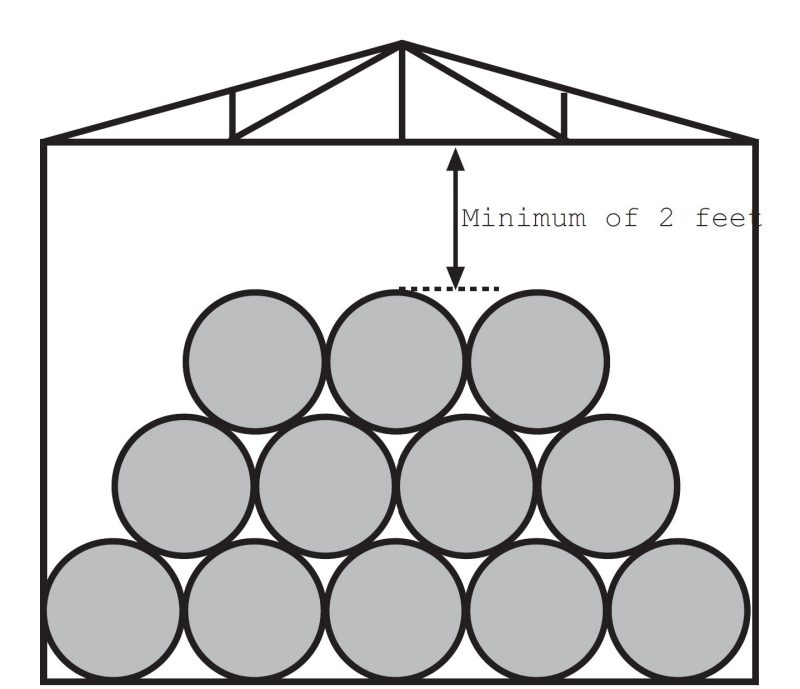

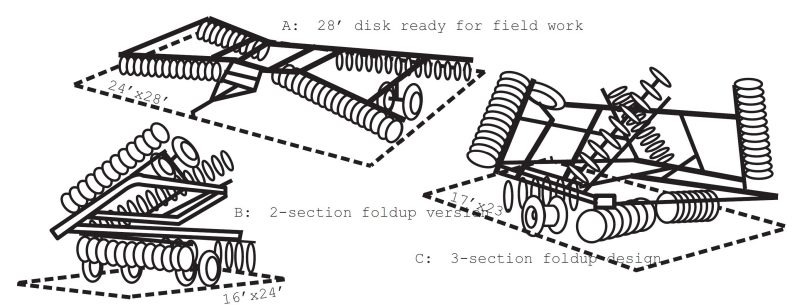

Example 2. Large round hay bales are stored in the barn described in Example 1. Barn vertical clearance is 14 feet. The 1,000 - lb bales are 5 feet in diameter and 4 feet wide. Bales are stacked vertically in a pyramid pattern (Figure 1). A total of 408 bales or 204 tons of hay (408 bales x 0.5 tons/lb) can be stored in the barn. Value of the hay is $65 per ton of dry matter. Hay dry matter content is 85 percent. Determine the value of hay stored in the barn and the net annual savings for barn storage (Table 3).

| Study | Ground Stored | Elevated on Pallets | Elevated on Pallets and Covered with a Tarp | Covered with a Tarp Only | Barn Stored |

|---|---|---|---|---|---|

| Ely (1984) | 65 | 38 | 14 | — | 4 |

| Collins et al. (1987) | 50 | 32 | 14 | — | 4 |

| Hoveland et al. (1997) | 30 | — | — | 10 | 0 |

| Value for Example Barn |

|---|

Dry matter stored = 0.85 x 204 tons = 173 tons Hay value = $65/ton x 173 tons = $11,245 Total annual cost of building = $2,600 Net annual value = $11,245 - $2,600 = $8,645 |

| Value for Your Barn |

|---|

0.85 x ______tons = ______tons $______/ton x ______ tons = $_______ = ________ $______ - $______ = $_______ |

Hay value is based on dry matter content. A total of 173 tons (0.85 x 204 tons) of dry matter are stored in the barn in Example 2. Therefore, the value of hay stored in the barn is $11,245 ($65/ton x 173 tons). Net annual value is calculated by subtracting the annual cost of the building ($2,600) from the benefit of barn storage ($11,245). For Example 2, the net annual value is $8,645.

Example 3. The same large round hay bales described in Example 2 are stored unprotected on the ground. The tonnage and value of the hay are the same. Hay dry matter content is 57 percent. Determine the value of hay stored unprotected on the ground (Table 4).

| Value for Example Barn |

|---|

Dry matter stored = 0.57 x 204 tons = 116 tons Hay value = $65/ton x 116 tons = $7,540 Total annual cost of building = $0 Net annual value = $7,540 - $0 = $7,540 |

| Value for Your Barn |

|---|

0.57 x ______tons = ______tons $______/ton x ______ tons = $_______ = $0 $______ - $______ = $_______ |

The amount of dry matter stored on the ground is 116 tons (0.57 x 204 tons). Therefore, the value of hay stored on the ground is $7,540 ($65/ton x 116 tons). Since there is no annual cost of a storage barn, the net annual value for unprotected ground storage is $7,540.

The net annual value of storing hay in a barn is $8,645 as compared to the $7,540 value resulting from storing hay on the ground. Therefore, a total $1,105 is saved by barn storage. However, these savings are a conservative estimate that does not consider the added advantage of using the building for other purposes.

Benefits of Machinery Storage Barn of Machinery

The primary reason to store machinery in a building is to protect it from weather. Sunlight and moisture have adverse effects on belts, bearings, tires, paint, and many other components. As a result, machinery that has been stored in a barn usually has lower repair costs and less down time than machinery left in the field. Furthermore, a nationwide survey (Meador, 1981) indicated that farmers who traded in their machinery after five years of ownership received significantly more value for their equipment if it was stored in a building (Table 5). The average annual savings on barn storage of machinery is about 3.0 percent of the initial value of the machinery.

| Item | Percent of Resale Price 5 years |

Percent of Resale Price Per year |

|---|---|---|

| Tractor | 16.5 | 3.3 |

| Planters | 22.0 | 4.4 |

| Harvesting equipment | 23.7 | 4.7 |

| Tillage equipment | 10.0 | 2.0 |

In most cases, the economic benefits from storing machinery and equipment are much greater than the cost of the storage. The following example shows the annual savings for storage of selected equipment.

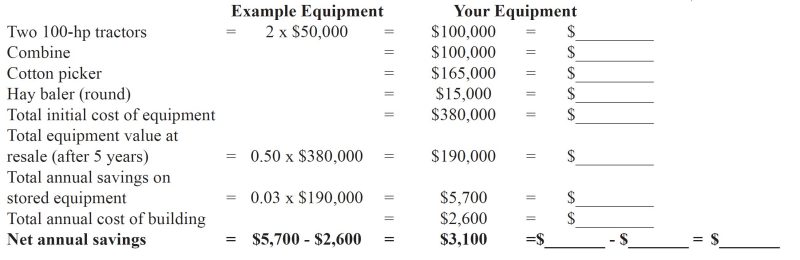

Example 4. Two 100-horse power tractors, a combine, a cotton picker, and a hay baler (round) are stored in the barn described in Example 1. The initial cost of each piece of machinery is $50,000 (per tractor), $100,000, $165,000, and $15,000, respectively. After five years, the equipment is traded in at 50.0 percent of its original value. The annual savings on storing the equipment is 3.0 percent of its trade-in value. Determine the net annual savings of barn storage of the machinery (Table 6).

Table 6. Calculation of the net annual savings created by storing several pieces of farm machinery.

The initial cost of the equipment is $380,000. At trade-in, the value of the equipment is $190,000 (0.50 x $380,000). Therefore, the total annual savings on barn storage of the equipment is $5,700 (0.03 x $190,000). The net annual savings is the total annual cost of the building ($2,600) subtracted from the total annual savings on barn storage of the equipment ($5,700) or $3,100. However, this is a conservative estimate considering that additional savings can be expected from reduced machinery down time. For additional details on the savings of stored machinery, see VCE Publication 442-451, Five Strategies for Extending Machinery Life.

Building Design for Hay Storage

The most desirable type of storage building for hay is one that has at least one end or side open. In Virginia, the opening should face south to prevent rain and snow from blowing into the building. The storage building should be clear span to eliminate working around interior poles.

Some building sizes work better than others for round bale storage. Building dimensions are usually exterior measurements. However, a 50-foot wide building will not provide adequate space for ten 5-foot diameter bales placed side by side. Building height is another important consideration for hay storage. Interior building height should be at least 2 feet higher that the height of stacked bales. Note that sidewalls must be built to withstand the horizontal pressures from each row of bales.

Building Design for Machinery Storage

Building dimensions must account for adequate machinery clearance. For example, door width should provide at least 2 feet of clearance and door height should provide at least 1 foot of clearance for equipment brought into the shop. Building width should be at least twice the door width.

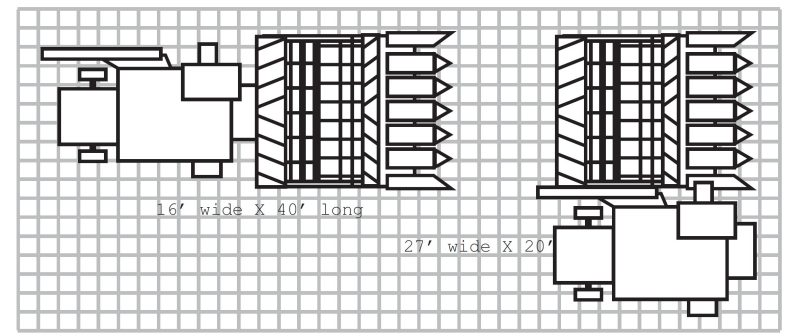

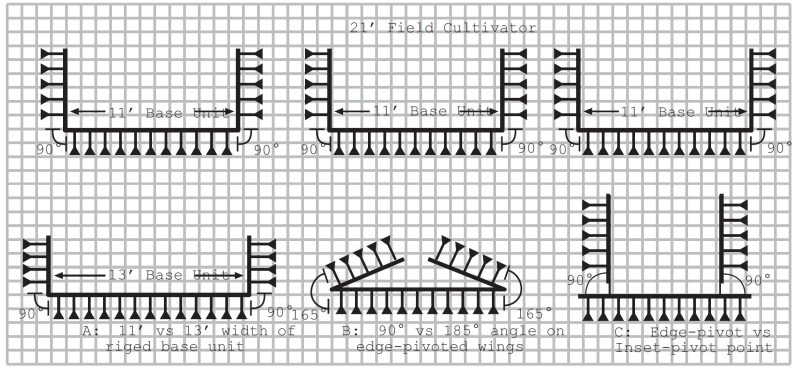

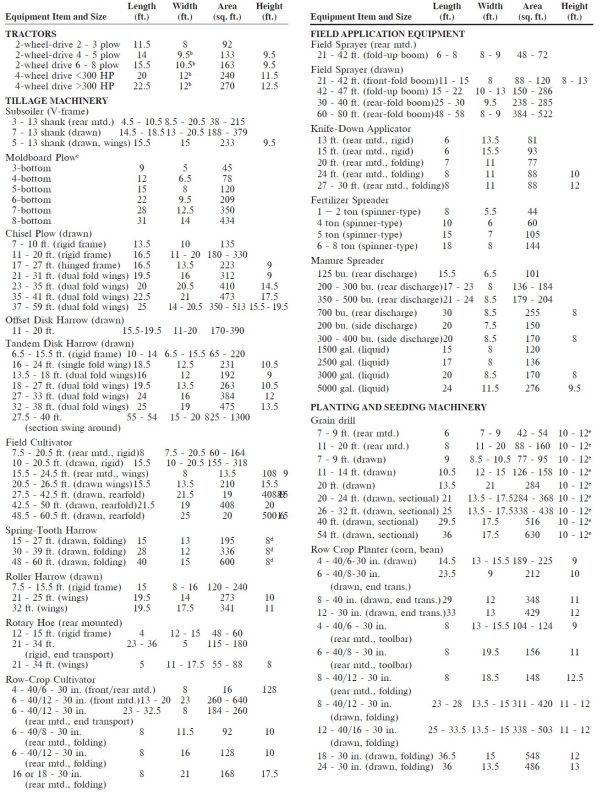

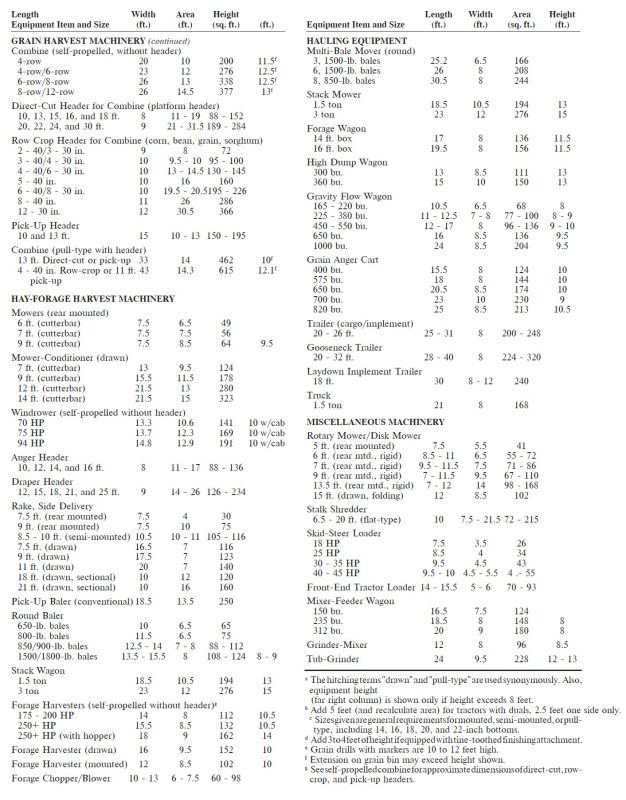

Planning for a machinery storage building also requires careful consideration of the estimated floor space requirements for the stored machinery. The floor space required for each particular item to be stored depends on a number of factors including fold-up configuration and whether or not implements remain hitched to machinery (Figures 2 - 4).

To determine minimum total storage area: 1) use actual area dimensions for current equipment and for machinery that may be purchased in the future (Table 8); 2) sum the areas of all items to be stored; and 3) multiply the total area by 1.15 to account for space between equipment.

The minimum requirement for floor space is merely a starting point for sizing the building. This floor space requirement may account for future storage needs, but does not consider overnight or short-term storage needs when it would be desirable to leave implements hitched to tractors. During such times, these units may have to be left outside or stored elsewhere – unless planned for in the original design.

General Building Recommendations

- Open-sided buildings should be oriented from east to west to minimize sunlight exposure inside the building.

- Three-sided buildings should be oriented so that the open side faces away from the prevailing wind (generally from the south) to minimize the amount of rain blown into the building.

- All buildings should meet the Virginia Uniform Statewide Building Code (USB) requirements.

- Obtain bids on different types of buildings and analyze the economics based on the examples in this publication.

- Keep hay storage buildings as open as possible in the gable ends (peak of the roof) to allow moisture to escape during hay drying.

- Consider ridge vents for large storage buildings. Condensation and rusting will occur on the inside of the roof if ridge vents are not used.

- Consider stacking large round hay bales on their flat end rather than on their round side to increase the number of bales that can be stored. This can be done with a 4-foot front-end-loader fork.

- Eave height should be at least 14 feet, but make sure that your building is high enough for your needs.

References

Collins, W.H., B.R. McKinnon, and J.P. Mason. 1987. Hay production and storage: economic comparison of selected management systems. ASAE Paper No. 87-4504. ASAE: St. Joseph, MI.

Ely, L.C. 1984. The quality of stored round hay bales or how much of your hay bale is left to feed. Georgia Dairyfax. January 1984. Animal and Dairy Science Department, University of Georgia, Athens, GA.

Hoveland, C.S., J.C. Garner, and M.A. McCann. 1997. Does it pay to cover hay bales? The Georgia Cattleman, July, 1997, pp. 9-10.

Meador, N. 1981. Spend 35% of equipment investment for storage. Farm Building News, Sept. 1981. p. 56.

Publications

Farm Shop Plan Book, MWPS-26. 1985. The book illustrates floor plans, cross sections and construction details for four farm shops sizes: 24’ x 32’; 32’ x 40’; 40’ x 48’; and 48’ x 56’ (32 Pages).

Machine Shed: 40’ x 104’, MWPS-74143 - 13 ft height clearance with 40’ x 40’ shop

Machine Shed: 48’ x 96’, MWPS-74146 - 14 ft height clearance with 48’ x 40’ shop

Machine Shed: 60’ x 96’, MWPS-74147 - 14 ft height clearance with 60’ x 40’ shop

Machine Shed: 30’ x 72’, MWPS-74148 - 12 ft height clearance with 30’ x 40’ shop

Machine Shed: 56’ x 88’, MWPS-74149 - 13 ft height clearance, no shop included, 40’ clear span with a 16’ shed attached for addition space.

To order MWPS publications, contact MidWest Plan Service, 122 Division Hall, Iowa State University, Ames, IA 50011 – 3080, 1-800-562-3618, www.mwpshq.org

Acknowledgments

Drs. Susan Gay and Robert Grisso are acknowledged for their contribution to the first version of this publication. The author would also like to would like to express their appreciation for the review and comments made by Lori S. Marsh, Associate Professor and Extension Engineer, Biological Systems Engineering; Keith Dickinson, Extension Agent, Crops and Soil Science, Fauquier County; and Robert M. Pitman, Superintendent, Eastern Virginia Agricultural Research and Extension Center.

Modified from:

Parson, S.D., R.M. Strickland, D.D. Jones and W.H. Friday. Planning guide to farm machinery storage. AE-115, Purdue University, Cooperative Extension Service, West Lafayette, IN

Hofman, V. and K. Hellevang. 1994. Planning Farm Shops. AE-1066, North Dakota State University Extension Service, Fargo, ND.

Worley, J. and W.D. Givan. 1999. Economics of Farm Storage Buildings. Bulletin 1173, University of Georgia Cooperative Extension, Athens, GA.

Table 8. Typical floor area requirements of various items of farm equipment.a

Virginia Cooperative Extension materials are available for public use, reprint, or citation without further permission, provided the use includes credit to the author and to Virginia Cooperative Extension, Virginia Tech, and Virginia State University.

Virginia Cooperative Extension is a partnership of Virginia Tech, Virginia State University, the U.S. Department of Agriculture, and local governments. Its programs and employment are open to all, regardless of age, color, disability, sex (including pregnancy), gender, gender identity, gender expression, national origin, political affiliation, race, religion, sexual orientation, genetic information, military status, or any other basis protected by law

Publication Date

March 8, 2019