Managing Farm Financial Stress for a Healthy Farm and a Healthy Farm Family

ID

ALCE-220NP (ALCE-249NP)

Introduction

The farm economy is in crisis, and farmers are under immense stress. Due to the often volatile and unpredictable nature of farming, farmers, especially minority farmers, encounter various threats. These can be classified as social (family, community), economic (land loss, financial stress), political (systemic discrimination, racism, policy), and environmental (droughts, floods, pest infestation) threats, which can affect the mental health and wellbeing of farmers (Braun, & Pippidis, 2020).

As noted, farm financial situations cause stress, depression, and with limited mental health professionals, farmers are likely to take drastic measures in addressing their mental health and well- being. Not only do these measures determine the health of the farm, business, or operation – they affect the health of the farmer and his/her/their family. For these reasons, we present this document to assist farmer and farm families in detecting early signs of farmer stress and to aid in managing farm finances. Personal and farm finance resources and tools are provided at the end.

Farm stress and health

In 2018, Farm Aid (a nonprofit agency whose mission is to help farmers remain in farming) reported that more than a thousand farmers in the United States dialed their crisis hotline, and over 450 farmers died by suicide across nine midwestern states between 2014 to 2018 (Farm Aid, 2018). While this is alarming, the Department of Health and Human Services noted that about 111 million people lived in areas, mainly rural areas, with a shortage of mental health professionals. Bringing it home to Virginia, a nationwide survey conducted by the American Foundation for Suicide prevention (2020) found that, suicide was the 10th leading cause of death particularly in the Appalachian region (Carroll, 2019). Virginia does not have an exact number of farmers who have died by suicide. According to the Center for Disease Control (CDC), this could be attributed to the fact that some suicides are easily reported as farm-related accidents and hence there may be more farmers dying by suicide that reported (Jared, 2019).

Also, because the overall financial wellbeing or viability of a farm is assessed by its financial performance: profitability, liquidity, solvency, and financial efficiency, any issue that affects these indicators can cause stress (American Psychological Association, 2019). Subsequently, the stress level of the farmer determines the health of a farm, business, or operation.

How does farm financial stress affect the mental health of farmers?

Unrelieved financial stress is a leading cause of premature death among adults and is considered a precursor to conditions and illnesses such as heart disease, hypertension, stroke, diabetes and possibly suicide (Miller, et al, 2012). Mental health professionals point to the volatile nature of farming as a potential cause of increased depression, substance abuse and both completed and uncompleted suicide among farmers (Shutske & Shutske, 2017). Also, the isolated environment, self- reliant, and independent nature of most farmers make them highly unlikely to ask for help, which exacerbates the tendency to take one’s own life as a final resort (Farm Aid, 2018).

Managing financials for a healthy farm and family

The first step to managing farm financial stress is understanding what constitutes a healthy farm. Most lenders and financial institutions look at a farm’s financials by focusing on three items: a balance sheet, an income statement, and cash (in/out) flow statement. When these financial documents reflect a positive financial outlook, there is less financial stress on the farmer. This is, particularly true of the cash flow statement, which is an indicator of the farm’s vitality and ability to keep the business running daily (Chandio et al., 2017). It should be noted that, these farm financials are usually put together by an accountant and will require about 3-5 years of consistent documentation to tell a story about a farm’s financial outlook.

The balance sheet: It tells us how much a farm has (assets), its debts (liabilities), and net worth (owner equity). It tells us whether the farm has enough assets to cover debts within a given time of the year. It focuses on two main concepts: solvency and liquidity (Kantrovich, 2011). Solvency is the ability of a farm to pay off all its debts if it were sold today. This is important in evaluating the risk and borrowing capacity of the business. It focuses on the debt-to-asset, equity-to-asset, and debt-to-equity ratios. Liquidity looks at a farm’s ability to pay financial debts as they come due.

Income Statement: It estimates profitability and shows how the business got to its current financial situation on an annual basis (Kantrovich, 2011; Robinson, 2020). Profitability refers to the difference between the value of goods produced and the cost of the materials used to make them. Simply put, this is the profit made from investments in the factors of production: capital, labor, and land (revenue – costs = profit).

The cash (in/out) flow statement: It is a combination of the balance sheet and income statement. It relies on information from both to explain the in- and outflow of income and how the farm utilized them (Kantrovich, 2011). It focuses on repayment capacity, or the ability to repay scheduled term debt and the farm’s ability to take on additional term debt.

Causes of financial stress

Financial risks such as increased input costs, high levels of debt, low working capital, low savings, and or poor or incomplete budgeting for yearly needs are some of the financial risks that farmers encounter in their operations (Miller, et al., 2012). These financial risks, when present destabilize, distress, and impede farmers due to the inability to pay bills, increased debt, and potential loss of owner equity. Increased financial risk also reduces the overall financial health of the farm. Thus, farmers need to be able to turn to trusted financial advisors and friends for support.

What are some signs of financial stress?

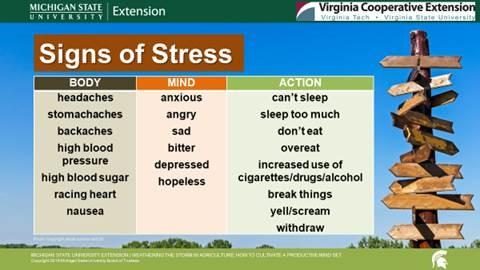

Generally, signs of stress can be experienced physically (body), psychologically (mind), and through actions. Often, there are some non-verbal and less detectable cues that are subtle indications of stress such as lack of eye contact, fidgeting with the hands, having a distant look in the eye or even a twitch of the eye (Braun & Pippidis, 2020). These cues should not be overlooked by the family, friends, and neighbors of farmers.

Do farmers feel safe to talk about mental health?

In an article published by The Guardian in February 2020, a young farmer stated, “I’m 20 years old and farming alone, and I am constantly putting a brave face on…yet deep down I’m pretty much breaking inside…” (Levitt, 2020). As people who prefer to keep their struggles to themselves, farmers worry about their privacy and the perceptions community members may have about them and their business, they choose to tough their way through stress, de-prioritizing their health and well-being to get the job done (Farm Aid, 2018).

Also, most farmers may not willingly accept or admit that they are stressed since most would view mental health issues or stress as an urban office or corporate world concept and may choose to ignore early signs of depression and anxiety (Farm Aid, 2018).

How to recognize early signs of mental health concerns among farmers?

- Lack of enthusiasm in maintaining farm environment

- Lack of interest in participating in off-farm outreach programs or communal activities

- Intentional isolation

- Increase in alcohol/substance abuse

- Nonverbal cues such as fidgeting, biting the nails, distractive tapping of the feet or hands.

- Physically drained and unkempt appearance

- Increase in farm accidents

How to communicate with a farmer going through stress?

These questions developed at Michigan State University provide helpful communication tips in working with distressed farmers (Thompson & Sanguesa, 2019):

- I hear you saying (repeat back the main concerns the farmer is expressing).

- This sounds like a lot to manage. How are you coping with this?

- What can I do to support you?

- Would it be helpful if we work together on an action plan for how to manage your concerns?

- Avoid making statements such as: “don’t worry too much about it”, “everyone goes through these in life”, “don’t make a big deal out of it”, “it’s probably nothing to worry about”. Such statements are dismissive and likely to make the individual withdraw further.

In another article published by USA Today Network in March 2020 titled “Seeds of Despair: For some farmers, the burden is too much to bear,” Theresia Gillie lost her 53-year-old husband Keith to suicide in 2017 (Wedell, & Chadde, 2020). Though Theresia reached out to a marketing and loan officer for help, Keith took his life before the assistance could be finalized. The worrisome aspect of this and several other scenarios is that, help often comes after the fact, hence, more training is needed for people who interact with farmers and ranchers on a daily basis in identifying the signs of stress.

Mental health resources related to farm stress

Emotional stress can sometimes be overlooked by farmers and farm families. Usually, when a farmer experiences financial stress and tension, when help is not received in ample time, it leads to erratic emotional stress such as mood swings, depression, unusual compulsive behavior. There are, however, immediate and service provider resources to assist farmers and farm families who need help dealing with emotional stress related to farm financial stress:

Farm Aid’s Hot Line: 1-800-FARM-AID: It is a non-profit organization aimed at keeping families on their farms. Their hotline provides 24 hours service to distressed farmers and ranchers who are at risk of losing their farms through financial stress.

Farmers Business Network Health: Provides health insurance specifically designed for farmers according to their budget and health needs. More information can be found at

www.fbnhealth.com

National Suicide Prevention Lifeline: Dial 800-273-8255 or visit

www.suicidepreventionlifeline.org/talk-to-someone-now

A national hotline for anyone going through stress or having suicidal thoughts. They provide nondisclosure assistance whereby your information is kept anonymous.

National Alliance on Mental Illness Virginia: Provide improvement and recovery assistance to persons living with serious mental health illness. Crisis Text Line: Text HOME to 741741

Virginia Department of Behavioral Health and Developmental Services: Provide resources and assistance to veterans suffering from PTSD, persons with mental health illness, and people recovering from substance abuse. More information can be found at www.dbhds.virginia.gov

Resources to assist farmers in managing farm and personal finances

Several programs offer personal and farm financial management tools on a variety of topics relevant to farm families that are designed to improve the financial health of the farm. Below are suggested tools for managing personal and farm finances. These resources are provided for both state levels (Virginia) and National.

Virginia farm finance resources

Virginia Cooperative Extension’s Farm Safety, Health, and Wellness Program: This expansive program assists farmers locating and accessing resources, trainings and technical assistance on farm safety, farm financial health, and personal and mental health for farmers and farm families. This is available through AgrAbility Virginia:

https://agrability.alce.vt.edu/publications/SafetyHealthWellness.html

Evaluating Financial Record System and Farm Financial Health by Dr. Alex White: This Virginia Cooperative Extension webinar focuses on evaluating and managing farm financial records. Dr. White explains the foundations of farm financial statements and how to manage them for long-term viability. The link to the webinar is found here: https://www.youtube.com/watch?v=Ju1S7WwwQvY&feature=youtu.be

Virginia Foundation for Agriculture, Innovation and Rural Sustainability (Virginia FAIRS): Provides financial assistance to rural folks and promotes cooperative and business development. More information available at https://www.vafairs.com/

Virginia Farm Service Agency (FSA): Assists beginning farmers and ranchers who are unable to access financing from commercial financial agencies with direct loans. More information is available at https://www.fsa.usda.gov/programs-and-services/farm-loan-programs/farm-ownership-loans/index

Farm Credit of the Virginias Knowledge Center Facilitates the sharing of knowledge and resources for the betterment of farmers and those interested in agriculture, including topics on financial management, marketing, business planning and more. Visit them at:

https://www.farmcreditofvirginias.com/knowledge-center

National Farm Finance Resources

Michigan State University (MSU) extension’s Stress Management program: MSU’s extension webpage contains several resources and programs designed to assist farmers and their families learn more about the causes and cost of stress. It also has financial stress management programs such as the teletherapy program designed to aid farmers in the fisheries sector. More information is available at: https://www.canr.msu.edu/managing_farm_stress/farm-stress

The Oklahoma Farm and Ranch (Financial) Stress Test: This test is designed to provide insight into sources of farm financial stress and the extent of stress. It highlights some key financial measures and provides a visual interpretation of the numbers. This test can be found at:

http://dasnr22.dasnr.okstate.edu/docushare/dsweb/Get/Version-4797/F-237web-color.pdf

Interpreting Financial Statements and Measures (IFSaM): This online self-paced tool is designed to assist farmers in learning how to utilize financial statements in their day-to-day management, understand how to interpret common financial statements, acquire skill sets to enhance their farm business and help gain self-confidence in finance. This resource can be found at:

https://ifsam.cffm.umn.edu/

AgPlan: It is a free of charge educational program designed to provide customized assistance to different types of rural businesses in developing their business plans. This resource was developed by the Center for Farm Financial Management at the University of Minnesota at:

https://agplan.umn.edu/

Ohio State University extension and Outreach Ag Decision Maker: This webpage contains several resources designed to assist farmers make financial decisions. It also has sample spreadsheets of financial statements. The resource can be found at:

https://www.extension.iastate.edu/agdm/decisionaidswd.html#f

Rural Finance and investment learning center resources: This website provides financial and investment resources and training for rural farmers. These resources can be found at:

http://www.ruralfinanceandinvestment.org/

Financial Security for All through eXtension: This online resource comprises a variety of articles and online learning modules that are provided by the Extension community with a focus on personal financial management, basic money management, retirement planning, and investment. These resource are located at: https://personalfinance.extension.org/financial-security-for-alllearning-lessons/

Southern Risk Management Education Center: Provides funding for educational projects to assist farmers and ranchers to manage and improve the complex financial risks associated with their businesses effectively. More information can be found at

https://srmec.uaex.edu/Links/financial-stress.aspx

Personal Finance Tools

Personal finance refers to an individual’s goals and investments that are appropriate for their economic circumstances. Personal financial tools in essence assist farmers to plan, invest and allocate their personal funds having in mind their economic circumstances. Below are suggested tools for managing personal finances.

Virginia Cooperative Extension’s Family Financial Management Program: This comprehensive program helps secure healthy financial futures for Virginia families through education and technical assistance on a range of financial topics. Visit: https://ext.vt.edu/family/financial-management.html

Counting Your Money Calendar: This tool, developed by Ohio State University Extension, is designed to help individuals track their income and expenses. It consists of a fillable calendar and a budget worksheet. This worksheet can be used by farmers to track their income and expenses. It can be found at: https://extensionpubs.osu.edu/counting-yourmoney-calendar/

Consumer Financial Protection Bureau’s Financial Wellness Scale: A free tool developed to assist in measuring an individual’s financial well- being. The scale consists of 10 questions which captures how people feel about their financial security and freedom of choice. Scores for the overall financial well-being ranges between 0 and 100. Guidelines for using the tool are available at: https://www.consumerfinance.gov/practitionerresour ces/financial-well-being-resources/measureand-score/

My Retirement Paycheck: This resource assists individuals in making retirement decisions. It explores aspects of one’s life that work together to make up a retirement paycheck. The tool was developed by the National Endowment for Financial Education and can be found at: https://www.myretirementpaycheck.org/

References

American Psychological Association. (2019, August 26). The Farmer Mental Health Crisis: Understanding a Vulnerable Population. APA. Retrieved from:

https://www.apa.org/members/content/farmer-mental-health

Braun, B. & Pippidis, M. (2020, January). Farm and farm family risk and resilience guide for Extension educational programming. University of Maryland Extension and the University of Delaware Cooperative Extension. Retrieved May 28, 2020, from: Farm-and-Farm-Family-Risk-and-Resilience-Guide-1-17-20.pdf (udel.edu)

Carroll, L. 2019. Mental Health. NBC News. Retrieved July 4, 2020 from:

https://www.nbcnews.com/health/mental-health/suicide-rates-are-rising-especially-rural-america-n1050806

Chandio, A. A., Jiang, Y., Wei, F., Rehman, A., & Liu, D. (2017). Famers’ access to credit: Does collateral matter or cash flow matter? Evidence from Sindh, Pakistan. Cogent Economics & Finance, 5(1),

Farm Aid. (2018). Why farmers face unique threats from stress. Farm Aid. Retrieved May 27, 2020, from: https://www.farmaid.org/blog/fact-sheet/why-farmers-face-unique-threats-from-stress/

Jared, G. (2019). CDC: ‘Farm stress’, suicides a rising rural health concern. Retrieved from:

https://talkbusiness.net/2019/05/cdc-farm-stress-suicides-a-rising-rural-health-concern/

Kantrovich, A. (2011). Farm Financial Ratio series. Michigan State University Extension. Retrieved May 30, 2020, from:

https://www.canr.msu.edu/news/financial_ratios_par t_1_of_21_the_current_ratio

Levitt, T. (2020, February 27). ‘I’m constantly putting on a brave face’: farmers speak out on mental health. The Guardian. Retrieved May 30, 2020, from:

https://www.theguardian.com/environment/2020/feb/27/im-constantly-putting-on-a-brave-face-farmers-speak-out-on-mental-health

Michigan State University (2019). Communicating with Famers Under Stress. Retrieved from: Michigan State University Extension. Copyright by the MSU Board of Trustees, East Lansing, MI

Miller, A., Dobbins, C., Boehlje, M., Barnard, F., & Olynk, N. (2012). Measuring and Analyzing Farm Financial Performance. Purdue Extension.Robinson, T. R., Greuning, H., Henry, E., Broihahn, M. (2020). International financial statement analysis. John Wiley & Sons.

Shutske, J., & Shutske, J. (2017). Farm Stress and Decision-Making During Challenging Times. UW Center for Agricultural Safety and Health at the University of Wisconsin–Madison.

Thompson, D. & Sanguesa, P. B. (2019). How to talk with farmers under stress. Michigan State University Extension. Retrieved May 22, 2020, from:

https://www.canr.msu.edu/resources/how-to- talk-with-farmers-under-stress

Wedell, K., Sherman, L. & Chadde, S. (2020). Seeds of despair: For some farmers, the burden is too much to bear. USA Today Network and Midwest Center for Investigative Reporting. Retrieved from: https://www.wisfarmer.com/story/news/2020/03/17/isolated-limited-access-mental-health-care-100-s-dying-suicide/4997196002/

White, A. (2014). Personal financial management with Dr. Alex White. Retrieved May 28, 2020 from https://www.northwestfcs.com/~/media/Files/B MC/White Webinar Presentation - FINAL.ashx

Funding provided by the “Reducing Human & Financial Risk for Beginning, Military Veteran, & Historically Underserved Farmers through Farm Stress, Wellness, & Safety Education” project of the Southern Extension Risk Management Education Center in partnership with the Virginia Beginning Farmer and Rancher Coalition and AgrAbility Virginia Program.

Virginia Cooperative Extension materials are available for public use, reprint, or citation without further permission, provided the use includes credit to the author and to Virginia Cooperative Extension, Virginia Tech, and Virginia State University.

Virginia Cooperative Extension is a partnership of Virginia Tech, Virginia State University, the U.S. Department of Agriculture (USDA), and local governments, and is an equal opportunity employer. For the full non-discrimination statement, please visit ext.vt.edu/accessibility.

Publication Date

May 24, 2021